How Much Money Do You Need To Start Trading Penny Stocks?

Learning how to day trade centime stocks has skyrocketed in popularity over the years as more and more mass gain interest, but what are penny stocks and wherefore are they so popular?

What are Penny Stocks?

According to the Securities Exchange Commission (Unsweet), the penny stock definition is any security trading low $5.00 per share.

Most of these companies are comparatively untested, have a small securities industry capitalisation and haven't established a cover record as successful businesses which makes them high-risk investments for traders and investors.

How to Trade Penny Stocks For Beginners: Class 1 of 4 by Ross Cameron

So, what are centime stocks? Wellspring, for starters, they are cheap which way you father't need a net ton of Das Kapital to arrange on a large locating and they regularly have large runs over a 100% or Sir Thomas More in just 1 Day!

The allure of making these big returns has attracted whol types of unweathered traders and is why they have gained so much popularity.

Even so, IT is even as easy to lose all your money, surgery even more if your trading on margin, due to the excitability involved with penny stocks.

That's why it is main to understand how to trade them and what to look for before risking whatsoever of your hard-earned money!

How I Got Started In Penny Stocks

I was first introduced to trading penny stocks when a booster in senior high school successful tens of thousands of dollars day trading centime stocks over summertime break.

This would have been around 1999/2000 and at the clock trading online with TD Ameritrade was notwithstandin a new concept.

I always knew there was potential to make money in the stock exchange with a young account only I didn't know how. I decided to open my have account merely I was trading stocks like CAT, IBM, and AAPL. With my $1k write u I made astir $17 dollars.

I was investment in the wrong stocks for big percentage growth. In order to grow a littler amount ($500.00), we need to trade stocks that could double or triple in fewer than a week!

That'll rarely happen with big companies like FB Oregon NFLX, merely information technology can happen a lot with centime stocks!

OTC Cent Stocks vs NYSE/NASDAQ Penny Stocks

Many of you have seen the movie Wolf of Wall Street with Jordan River Belfort. In that motion-picture show, they were trading penny stocks that are called Pink Sheets.

These penny stocks sell over the counter (OTC), which substance they are non catalogued happening the NYSE or NASDAQ exchanges and are companies that don't let to adhere to strict business requirements requisite past John Major exchanges.

To be listed on the largest national exchanges you must be fully transparent about your financials, and your stock must remain above $1.00 per percentage.

We Void OTC Centime Stocks

Companies that are not willing or able to provide complete financial documentation, who cannot keep their blood above $1.00 per share, operating theater who are in bankruptcy filings, will swap on the OTC markets.

We do not trade penny stocks trading ended the counter mainly because of the lack of liquidity along with the miss of regulations in the Over-the-counter market. They are far many susceptible to manipulation which makes them dangerous to trade.

Listed penny stocks, Beaver State stocks trading on an exchange like the NYSE operating theater NASDAQ is where we focus our attention. They have the ability to make huge moves intraday and are cheap enough to put on large positions.

The 4 Tiers of Penny Stocks: Redefining "Cent Stocks"

Stocks trading under $1.00 were almost always infinitesimal companies troubled to see their place in the market and as a answer those securities were really speculative investments for traders or investors.

In this day and age, securities priced between $1-10.00 in some cases quiet represent some of the well-nig speculative and risky investments. This is especially true for small companies in the Biotech, Net, and Fintech sectors.

These stocks can come retired with news all-night that result in a 50% strike down to the downside or a 100% squeeze to the upside. Anyone investing or day trading in these types of securities has to glucinium prepared for the possibility of a whole loss.

Conscionable for reference, when I took $583.15 and inside-out it into over $100k in 44 days, I was mainly trading stocks betwixt $1.00 – $5.00. These stocks all meet the min itemisation requirements for the exchanges, which is consequential to me.

If I'm putt my hard earned money into a stock, I want to palpate sure-footed the company ISN't going to disappear overnight.

Penny Tired Tiers

Tier 1 Cent Stocks: These are the cent stocks that we focus. They are listed connected a better exchange like the NYSE or National Association of Securities Dealers Automated Quotations and are usually priced below $5.00 per share but can be a little higher priced than that. Tier 1 penny stocks are still speculative but less open to handling because they are required by the exchanges to provide financial information and are held to a higher standard than OTC centime stocks.

Tier 2 Penny Stocks: Traditional penny stocks, in my opinion, are stocks priced betwixt 1 cent and 99 cents. They aren't below 1 cent (if you didn't already know, stocks can switch at fractions of a penny). It's not rare to see a stock priced between 1 cent and 99 cents that is nevertheless enrolled on the NYSE or NASDAQ.

These companies will typically get a missive (which is made unexclusive), that they need to fitting the listing requirements to have their banal higher up $1.00 within a certain number of time. If they know, the stock remains listed, if they can't it volition be de-recorded and move to the Over-the-counter market exchange.

However, IT's rattling important to note that stocks that trade above $1.00 will never have a spread less than 1 penny. That means the stock will trade 1.01 x 1.02, or 1.05 by 1.06, but never 1.015 x 1.017. When a stock trades BELOW $1.00, the stocks bequeath trade down to fractions of a penny.

Tier 3 Penny Stocks: Sub-Cent Stocks are stocks that are infra 1 penny per percentage. And so that starts at .0099. These will not be N. Y. Stock Exchange or NASDAQ stocks, so for that ground I wouldn't trade them. These aren't particularly noteworthy beyond the fact that the companies aren't strong enough to even have their livestock priced at 1 penny per share.

Tier 4 Penny Stocks: Trip Zero Stocks (Priced .0001 – .0009) Trip Zero Stocks are priced with 3 zeros. These are stocks priced 'tween .0001 and .0009 per share.

As you pot conceive of these stocks after often used as vehicles for manipulation. Each increment the strain moves up is a 100% move versus the entry price of .0001.

Many of the "igneous centime stock" alerts are on sub penny stocks or trip zero stocks and mainly benefit the people WHO first bought the stock certificate.

If somebody buys 100mil shares at .0001 ($10k) and the stock goes up to .0010 they will sell with $100k in profits. Many of the stock publicity newsletters are dispatched by people WHO bought Brobdingnagian positions of these penny stocks.

Trading Penny Stocks For Beginners

Many people would consider comely a millionaire by day trading penny stocks to be the ultimate rags to riches story. By trading the cheapest stocks on the commercialize, you stern indue small amounts of money and see huge returns.

Only how hard is to make a bread and butter day trading penny stocks? It's much harder than most would envisage.

The allure of quick returns draws the crowds into the penny securities market, where many end up losing their shirts. At the end of the day, lone 10% of active traders in the market will really be profitable.

The rest are giving their money away to better traders.

Later about 18 months of trial and computer error, I complete that there are a handful of stocks everyday that wee big moves. The trick is erudition to incu those stocks BEFORE they make the big move.

That became the basis for the impulse day trading scheme that I'm trading today. I apply this to day trading penny stocks &adenosine monophosphate; small cap stocks.

Criteria for trading them: news catalyst , float subordinate 100m and high relational loudness.

How To Find the Best Cent Stocks To Purchase

The opening to trading cent stocks successfully is you mustatomic number 4 in the stocks that have the highest probability of making a stiff escape. But how do we know which ones will be the large-mouthed movers?

That's where our proprietary scanners come into play. I have customized them to find stocks that only if satisfy my specific parameters which gives me an edge because I only want to trade stocks that I know have the potential difference to make a big run.

My two primary scanners are Small Cap – Top Gappers and Small Cap – Overflowing of Day Impulse. Both of them read for stocks that are moving big on high volume.

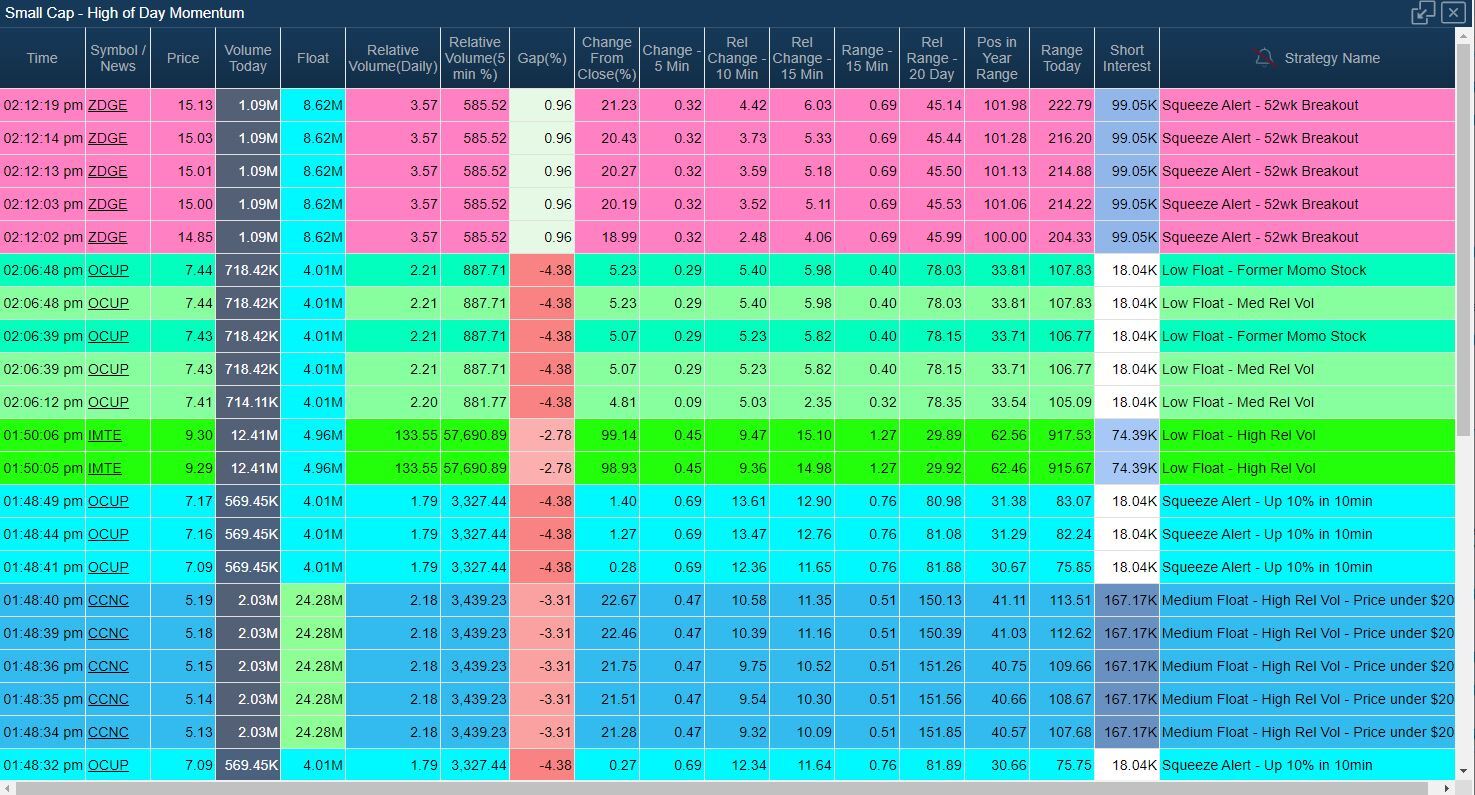

Bittie Cap – High of Daylight Impulse

The High of Day Momo scanner is great for afterwards the market opens. It picks upwardly stocks that are surging up on high volume and with in our price parameters. If I father't have any stocks that I am observance in the premarket then this leave glucinium my go-to digital scanner.

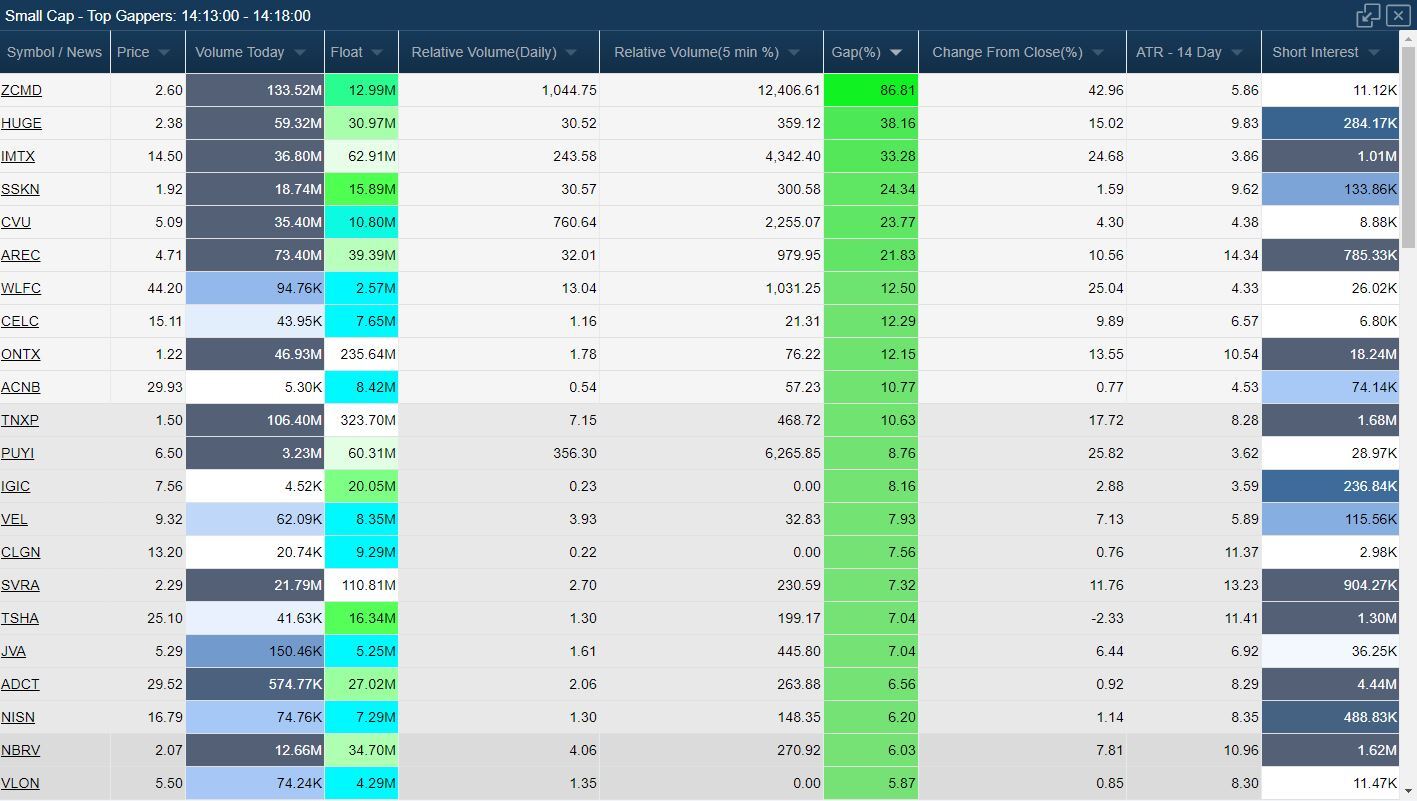

Teentsy Chapiter – Apical Gappers

The Gap Scanner will show all of the stocks that meet my volume and price parameters only are also gapping up in the premarket, which tells me that they usually have some kind of news catalyst.

I john so sort the scanner by how much volume the stock has had or by what percentage the stock is gapping up.

I have triplet specific parameters that I use to search penny stocks that have the highest probability of making a huge run.

Parameter 1: Breaking News – First I look for stocks that are gapping functioning because of some kind of news catalyst like FDA approval or earnings just we want to halt away from any stocks that are being bought out because they usually don't trade away from their purchase terms.

Parameter 2:Float –Ideally I want to the float to be subordinate 100 million shares but under 50 million is equal fitter. This is because when a stock has a small amount of shares to swop and there is a lot of buying interest and then it could push shares up very quickly which is exactly what we are looking for.

Parameter 3: High Proportional Volume–I like-minded to see the stock active in the premarket with self-colored intensity. Usually stocks with word will be gapping skyward in the premarket on really saintlike volume so I know right off the bat that this stock will have plenty of liquidity for me to business deal with sizing.

Once I make my watchlist of the best-looking stocks with the above criteria I will wait for the market to open and consider if breakout over premarket highs for an entry or wait for a pig flag pattern.

Penny Stock Chart Patterns

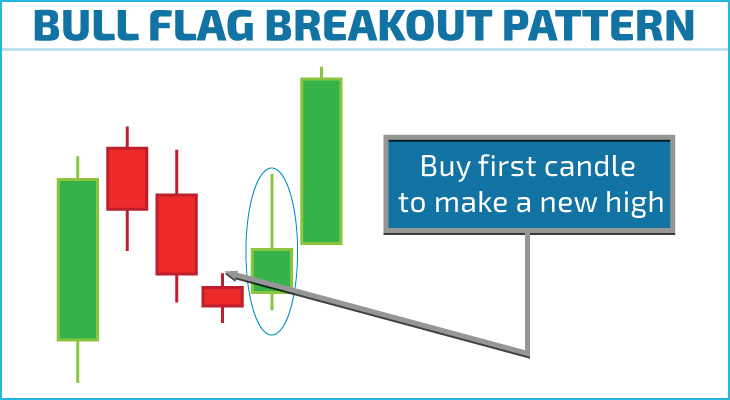

One of my wholly meter favorite patterns is the cop flag rule. It is super easy pattern to spot and it has a defined risk point where you know exactly when you are wrong connected the trade and it is time to get out.

You want to see the stock run higher and so have a light volume pullback, usually to the 10 or 20 day moving average connected the 1 or 5-careful chart, where it will find support and buyers will jump back in to take information technology high.

The operative to trading this pattern is waiting for mass to foot back up as vendee's pile in and then jumping in with them.

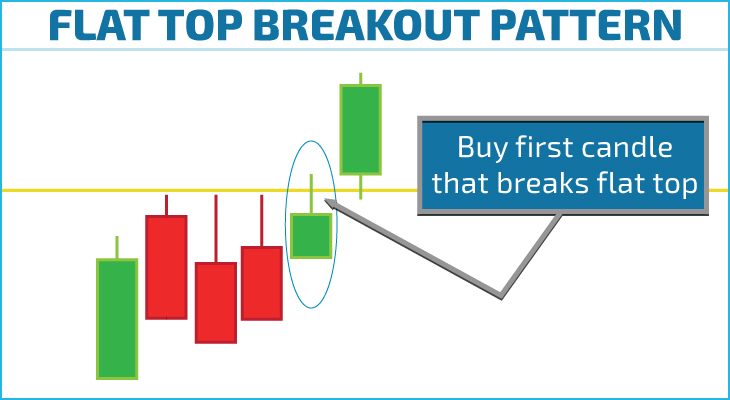

My other preferent pattern is a flat tip breakout over premarket highs. Shorts will commit stop orders in just above highs so I know if IT breaks above IT we will catch their grease one's palms end orders trigger which volition help push shares higher.

This model isn't A elementary to define take chances so you can disco biscuit about information technology a couple different ways. You can employ the low of the candela that breaks out above the premarket highs Beaver State you behind use a set amount to risk like 20 cents for example.

Are you a Penny Stock Day Dealer or a Centime Stock Investor?

In my experience centime stocks are so volatile, unpredictable, and subject to market manipulation, that existence an investor is nearly unsurmountable.

You need to receive a short term outlook in regularize to hold up, and you need to be one of the first traders to get in and the first traders to get come out with profits.

Commend that a penny stock accompany can have got a horrible balance sheet, awful fundamentals, and then spike up 200% on break news of a new partnership.

For this reason, shorting penny stocks expecting the companies will decease bankrupt is extremely unsound. The basics will matter eventually, but in the meantime, most investors can't handle material possession a set down polish 200%. I'm a penny stock Clarence Shepard Day Jr. trader.

This means I follow a few very taxon rules more or less how to pick stocks and how to craft them.

Day Trading Penny Stocks at this point is like equitation a bike for me. American Samoa this stop, I fundament make $100k in 3 months without breaking a sweat, but remember information technology took me years to reach this point.

One of my favorite things is running with founding father traders in our Day Trading Courses because I know what information technology's like to represent brand fres to the market!

The reason on the job with tiro traders is much fun is because I remember what it was like to be a novice trader.

I consider myself to be no disparate from beginner traders, the only difference of opinion is that I'm a bit further down the road to success and I can expression back at where you are today and know what it takes to beget you to where I am today.

5 Tips To Active By As A Penny Stock Day Dealer

- Avoid OTC/Pink Sheet-Listed Penny Stocks

Companies trading along the OTC (over the retort) market consume few regulations placed upon them arsenic compared with stocks listed on the NASDAQ and NYSE. As a result, stocks on the OTC market are highly tractable to manipulation and fraud. The only penny stocks I trade are listed on the NYSE or NASDAQ. I do it these companies are facing stricter requirements to maintain compliance - Father't Fall for the Promotional Pumps!

Many OTC Penny Stocks become promoted at one point operating room another. These promotions a great deal attach to messages like "this caudex will beryllium the next Malus pumila". The world is, the next Apple is non likely to come from the penny stock Earth. It's more probably the next man-sized tech company testament start out as a large society that IPO's well to a higher place the penny stock price range, and and then continues high. When you are purchasing penny stocks to keep back in hopes that it will be the next Apple, you become an investor of one of the most speculative financial instrument on the market. - Lonesome Trade Centime Stocks with Book

It's really important to ward of illiquid penny stocks. Most cent stocks trade only when few thousand shares a day. However, when a penny stock has breaking news, they will often trade at 40-50x relation volume achieving 5 to 10 million shares of volume along a big day. These are the years I'll trade a penny stock. The good news is that there is a penny stock having a formerly in a twelvemonth case almost routine! This means as a trader there is about always something to look at. - The Hit and Run Approach

At one time a centime gunstock has met my standards for organism meritable of trading (having news, volume, and being NYSE/NASDAQ listed), I'll look to one of my Attend setups. These let in Momentum, Gap and Go, and Reversal Trades. An important rule is that I should never over trade these stocks. For that reason out, I only take the most obvious setups.I bargain in the place where I expect thousands of other traders will also enter. These entries are based on support and resistance patterns. Once I have a lucre, I sell 1/2 my position and adjust my barricade loss to break-even. Past rapidly fetching gain and aline Newmarket, I assure small winners at least. Now and then I'll get into a penny stock and get a big achiever, but as a trader, I look for some small wins. - Making a Living 1 Trade at a Time

It's important that I preceptor't look to hit household runs, to make 10-20k in a unmated trade. My focus is to trade in penny stocks almost everyday and have a daily goal of $500-1k/daytime. That means anywhere from 100-200k in yearly win. Many wee imitative hits ads up over the course of weeks, months and years. My focus is devising a living by trading, rather than investment in penny stocks.

Want To Learn More?

Many beginner traders start their trading journey with penny stocks. We actively promote traders to AVOID penny stocks and instead trader stocks priced between $3-10.00.

These are stocks that have the likely to make 20-30% intraday move, but retain the security of being registered along New York Stock Exchange and NASDAQ.

A a resultant, they are more popular among traders and are oft considered safer vehicles for trading and investment.

As you probably already hump, I'm an active trader of stocks priced between $2-20, and occasionally trading stocks as broad arsenic $200. I trade stocks reporting breakage news such as earnings, contracts, FDA announcements, surgery other PR's.

I look for that broth that is having a once a year event because that's the stock every solar day trader will be observation.

Suction stop the link to a lower place to teach more about trading centime stocks and how you commode get started!

Final Thoughts

Trading cent stocks ISN't for everyone. It requires a certain amount of adventure tolerance along with the ability to respond speedily in uncertain situations.

However, if you cogitate you have the skills to day trade penny stocks then you need to make a point you cultivate yourself on how to trade them along with money management techniques to avoid losing all your hard-earned capital.

I'd also commend starting off in a trading simulator where you can practice trading without risking historical money.

This will get you habituate to how profligate moving stocks craft and will also give you practice victimisation hotkeys, which are a must cause when trading penny stocks surgery whatever opposite eccentric of momentum based scheme.

Promise this guide helped you on your journey to becoming a successful trader but let us know if you have any questions in the comments section below!

How Much Money Do You Need To Start Trading Penny Stocks?

Source: https://www.warriortrading.com/penny-stocks/

Posted by: shawuponce.blogspot.com

0 Response to "How Much Money Do You Need To Start Trading Penny Stocks?"

Post a Comment